A 30-something Seattle girl's quest to maximize net worth through frugal living and simplicity

Monday, February 27, 2006

Free Trial of MS Money Not Up To Snuff

Wednesday, February 22, 2006

Location, Location, Location

- four grocery stores

- the public library

- a post office

- two dozen or so great restaurants

- three neighborhood pubs

- four coffee shops

- a fun variety of retail shops

- a dry cleaner

- two fantastic parks

- a beautiful lake

- in easy bicycling distance of my office

When people comment on where I live, the conversation usually goes something like this:

Them: "You are so lucky to live in this awesome neighborhood!"

Me: "I agree that it is a fantastic neighborhood. But I am not lucky to live here. I chose to live here."

Them: "I could never afford to buy a house in this neighborhood."

Me: "Sure you can! It just wouldn't be as big as your current one."

Them: "But I couldn't live without my...(fill in the blank)...walk in closet, double garage, jacuzzi tub, four bedroom house, etc."

At that point I change the topic because folks like that can't imagine giving up a material possession or home amenity in exchange for the increased quality of life that a neighborhood community offers. I wouldn't trade my tiny one-bedroom condo in a fantastic neighborhood for a huge, hulking house in the strip-mall suburbs for ANYTHING!

Monday, February 20, 2006

Free Personal Finance Tools

My personal favorite is the lifetime savings calculator which allows you to calculate the lifetime savings of switching to a generic version of a particular product. It's simple math to do without a fancy Excel calculator, but it sure is fun to see how much you can save!

Sunday, February 19, 2006

I Think I Found Mr. Uber-Frugal!

The practice of voluntary simplicity was born of the idea that American consumerism traps us in the enless cycle of the rat race. Judith Levine writes of her 12-month experience of voluntary simplicity. Once I read the book, I will report back to share my thoughts.

Tuesday, February 14, 2006

Why My Heating Bills Never Exceed $40 a Month

This morning in Seattle, I awoke to a snowy winter wonderland, something that doesn't happen very often. There is a lot of pain this time of year due to soaring home heating costs. But in the two years that I've owned my condo, my monthly heating costs have never exceeded $40. I keep my thermostat at a reasonable setting in the winter - about 65 degrees, so I'm not sitting around bundled in a down jacket with my teeth chattering just to save a little money.

The secret to my low monthly heating bills is the fact that I live in a condo that is built to energy star standards which are strict energy efficiency guidelines set by the EPA. Based on my winter heating bills, energy star works! Plus it's good for the environment because I'm using less energy to heat my home since it is so well insulated, and therefore I'm saving money. Over a period of years, this will have a significant payback period.

Festival of Frugality is Up!

Sunday, February 12, 2006

Small Home = $15 Carpet Cleaning

The cleaning went very smoothly, and I had the entire project completed in about an hour. That includes renting the machine, completing the cleaning and returning the machine. My boyfriend, who just purchased a ridiculously huge 4-bedroom house, just paid $300 to have his carpets cleaned by professionals. Normally he would do something like that himself, but it was an overwhelming chore given the size of his new home. Of course you could clean your own carpets if you own a large house, but it becomes a much more onerous task.

So whenever I see someone's showcase home that causes me to think how nice it would be to have a guest room...back yard...utility room...basement...yadda yadda...I just remind myself of the little benefits of living small like being able to clean my carpet in one hour for just $15.

Friday, February 10, 2006

I Threatened to Cancel - They Paid Me $$

When I called Amex to cancel, they offered a couple of incentives to entice me to stay. Currently, I am required to carry a balance on the card (which I never do) to obtain the maximum cash back allowance. They permanently waived that requirement. In addition they offered a $25 one time credit to my account. I accepted the deal. Later when I have the time, I'll compare the cash back incentives for both cards, but in the mean time I'll enjoy the $25 credit!

Thursday, February 09, 2006

Close Call with Paypal Thief

I certainly learned a lesson in all this. When I received the email, I should have logged into Paypal separately to see if any transactions had taken place. That would have confirmed that the email was a fake. I hope nobody else falls prey to this scam.

Wednesday, February 08, 2006

Chronic Minimalism

A while back, the company was doing a 'restack' of employees. They shifted people around so workteams could sit closer together. I didn't have to move my desk, but I had several new people moved into adjacent cubicles. Not long after that occurred, I went on a two week vacation. When I returned, it was apparent that my new neighbors had assumed my cubicle was vacant, which is perfectly understandable given the minimalist state in which I left it. Somebody had swiped the keyboard from my computer; somebody else had helped themselves to my lovely plant. I had boxes of discarded files piled onto my desk, and boxes of trash stored underneath. I thought it was hilarious! Of course they thought the office was empty - I didn't leave the tiniest clue that a real person occupied the space.

I piled all of the boxes and garbage into the hallway, ordered a replacement keyboard from the IT department, and posted a sign on my computer that says, "THIS OFFICE IS OCCUPIED."

Sadly, I never recovered my little plant. I now do without...

Monday, February 06, 2006

Are Real Estate Agents Worth Their Large Fees?

Two Seattle-based companies, Redfin and Progressive, were profiled in this weekend's Seattle Times article. Both companies are breaking the 6% commission mold. I certainly hope this is a trend that will continue.

Wednesday, February 01, 2006

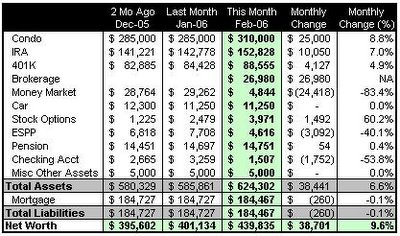

February Net Worth $439,835 (up $38,701)

- Revised condo valuation from $285,000 to $310,000

- Increase in IRA value of $10,000

- Increase in 401k value of $4,000

Because the new condo valuation is a one-time event, I expect my monthly net worth growth to settle down to approximately $5,000 to $8,000 per month going forward.

Detailed discussion on net worth items

- Pay down mortgage. One of my objectives for 2006 is to contribute $10,000 toward extra principle payments. I discovered that my mortgage lender, Countrywide, doesn't make it easy to make an extra payment online. I waited until too late in January to make an extra payment, so I will look to begin the extra payments this month.

- Reestablish ESPP contributions. My company stock is fairly volatile, and I got nervous and discontinued my monthly contributions. I plan to resume contributions in late February or early March after I've decided how much I want to contribute (my company allows 15% of base pay) based on the risk of the stock falling.