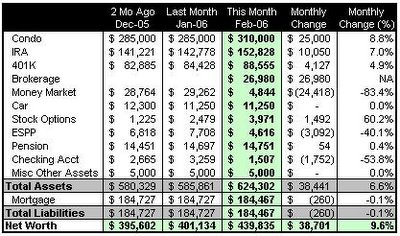

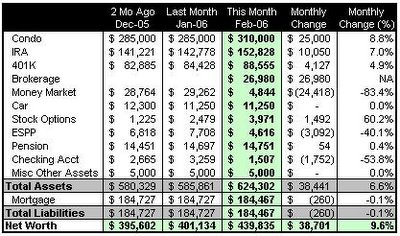

I wrapped up January with nearly $440,000 in net worth. This month's $38,701 net worth improvement was driven by the following factors:

- Revised condo valuation from $285,000 to $310,000

- Increase in IRA value of $10,000

- Increase in 401k value of $4,000

Because the new condo valuation is a one-time event, I expect my monthly net worth growth to settle down to approximately $5,000 to $8,000 per month going forward.

Detailed discussion on net worth itemsI revised my condo value from $285,000 to $310,000 using HomeValueBot.com. This added $25,000 to my net worth. When I ran the numbers on the HomeValueBot web site, they actually came out higher, but I decided to be conservative and stick with $310,000.

Detailed discussion on net worth itemsI revised my condo value from $285,000 to $310,000 using HomeValueBot.com. This added $25,000 to my net worth. When I ran the numbers on the HomeValueBot web site, they actually came out higher, but I decided to be conservative and stick with $310,000.

The increase in IRA value of $10,000 is a combination of investment gains, a $4,000 contribution for 2006 plus an additional $1,000 contribution for 2005 since I hadn't fully funded for last year.

A new brokerage line item appears this month. I have transferred funds from my money market into this account, which is invested in an assortment of Vanguard index funds.

My stock options are doing quite well, resulting in a gain of $1,492 over last month. However, I made the decision to cash out some of my ESPP to fund my IRA, so I missed out on some of those gains.

Important personal finance issues for the months ahead- Pay down mortgage. One of my objectives for 2006 is to contribute $10,000 toward extra principle payments. I discovered that my mortgage lender, Countrywide, doesn't make it easy to make an extra payment online. I waited until too late in January to make an extra payment, so I will look to begin the extra payments this month.

- Reestablish ESPP contributions. My company stock is fairly volatile, and I got nervous and discontinued my monthly contributions. I plan to resume contributions in late February or early March after I've decided how much I want to contribute (my company allows 15% of base pay) based on the risk of the stock falling.

No comments:

Post a Comment