Last night during our annual condo association homeowners meeting, I chose to end my two-year term as president of the board of directors. I had an urge to continue because I have strong opinions on how I want the place to be run. But I decided that it's good to let other homeowners participate in the work it takes to operate the condo. Plus it will be a nice break from the responsibilities.

It got me to thinking whether living in a condo is truly simpler than living in a house. I owned a house prior to buying the condo, so I have a perspective on both sides of the equation. When I owned my house (all 650 sq. ft. of it) I was completely overwhelmed with the yard maintenance and exterior maintenance of the place. Something always needed to be attended to whether it was edging the yard, mowing the lawn, painting the retaining wall, weeding the garden, replacing the porch light, roto-rooting the sewer line, and so on. Initially I tried to do most everything myself (except the sewer line issue) then I gradually started hiring out some of the work. But over time I always wound up canceling the workmen because I couldn't stand spending money on something I knew perfectly well I could do myself. So I cancelled the yard guy and I stopped using a handy man. The only thing I would hire out was plumbing work. I felt like I was saving a ton of money, but I also felt the weight of a growing to-do list.

When I first moved into my condo I was giddy with the prospect that

everything would be handled for me. I could just pick up the phone and report a burned out hallway light or a broken yard sprinkler and the maintenance men would show up and fix all the problems. In reality that did happen, but I find myself unhappy with the quality of work or the speed in which tasks get resolved. Also, I'm paying a healthy chunk of homeowners dues which is a non-negotiable expense. When you own your own house, you can choose whether to have a yard service handle the lawn one month, and do it yourself the next. That isn't an option in a condo. In addition, my condo has an elevator and a garage door that both require regular maintenance to operate properly. It's amazingly expensive. It is also an adjustment to have decision by committee, and to not be able to maintain the property exactly the way you personally see fit.

My 20-20 hindsight is crystal clear on this issue. I preferred the flexibility as a single-family home owner to hire out home maintenance tasks at my discretion. I didn't realize at the time that it's much more cost effective to hire out home maintenance for a house than to contribute monthly home owners dues for a condo, at least a condo that aspires to having a healthy reserve fund as mine does. This doesn't mean I'm going to sell my condo and run out and buy a single-family home. But I'm certainly more aware of the tradeoffs of both living situations now.

My condo living situation is certainly simpler based solely on the fact that our management company handles the maintenance issues that arise, and it will be even more simple now that I am not an active participant on the board of directors. But a single-family homeowner can create the same situation by investing time to identify good service providers to handle regular maintenance issues.

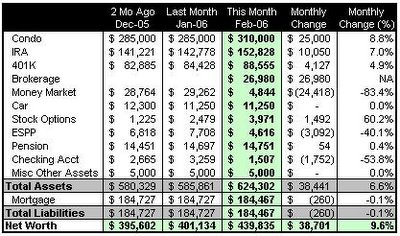

I broke the $400,000 barrier this month. This month's gains are mostly attributed to investment gains in my IRA, 401(k), ESPP and stock option accounts. I would like to devise a way to estimate my current condo value without bothering a local real estate agent. If anybody has any good resources, I'd like to learn about them.

I broke the $400,000 barrier this month. This month's gains are mostly attributed to investment gains in my IRA, 401(k), ESPP and stock option accounts. I would like to devise a way to estimate my current condo value without bothering a local real estate agent. If anybody has any good resources, I'd like to learn about them.